Relation between Simple Interest and Compound Interest

Let’s study the relation between simple and compound interests, their common points and differences. It will help us further to understand both these concepts, especially the concept of compound interest.

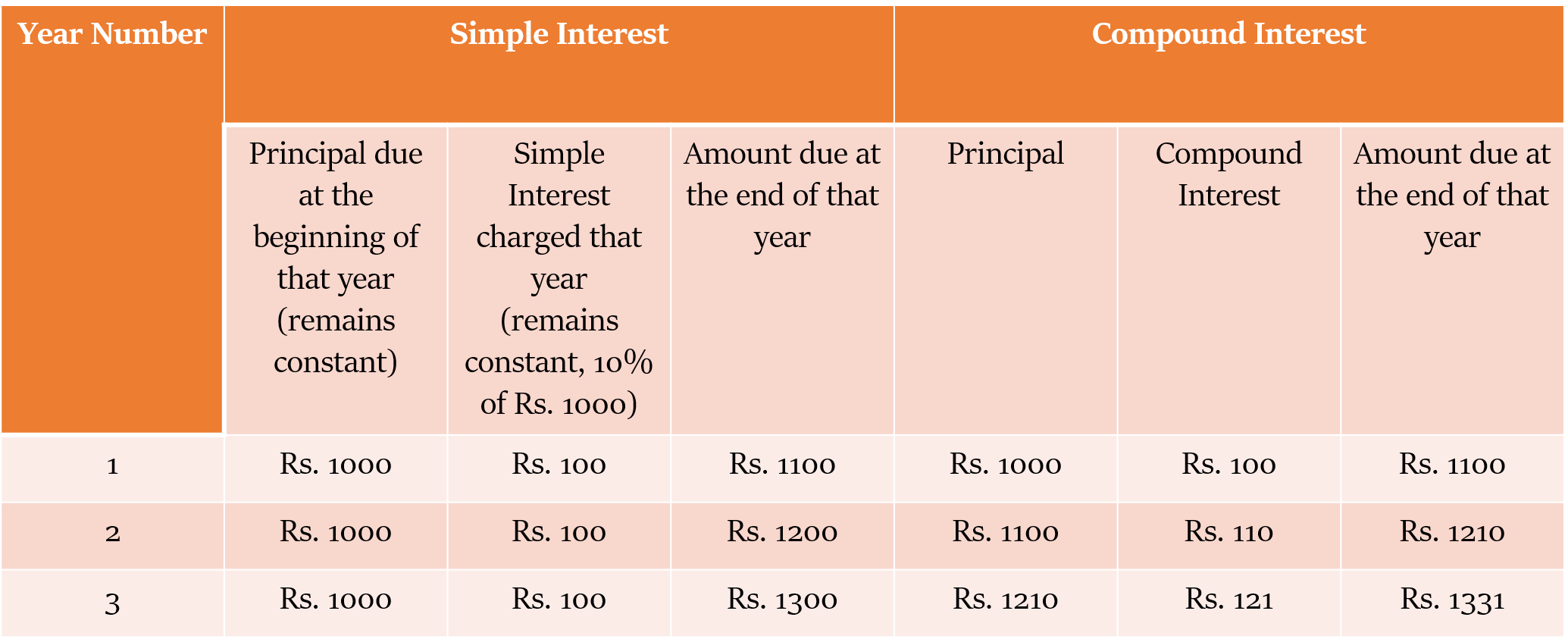

Have a look at the comparison table given below:

| Simple Interest | Compound Interest |

|---|---|

| The principal remains the same every year. | The amount at the end of an year is the Principal for the next year |

| The interest charged every year is the same (r% of P). | The interest for different years is not the same. It keeps on increasing. |

If compounding is done on a yearly basis, then the compound interest for the first year is the same as the simple interest for any one year.

The increase in the interest amount earned each year on account of CI is equal to r% of the interest earned in the previous year.

Example

For example, consider the scenario wherein Rs. 1000 is borrowed at 10%.

Q. The simple interest on a sum of money for 3 years is Rs. 390, and the compound interest on the same sum at the same rate for 2 years is Rs. 273. What must be the rate percent per annum?

(a) 25% (b) 30% (c) 15% (d) 10%

Explanation:

SI earned in 1st year = 390/3 = Rs. 130 (It will also be the CI for the 1st year)

CI for 2 years = Rs. 273 (i.e. 130 + 130 + 13)

So, extra CI earned in the 2nd year = Rs. 13 (This is the interest on Rs. 130 for 1 year)

So, Rate of Interest = (13/130) × 100 = 10%

Answer: (d)

Concept 1

Difference between CI and SI for 2 years (D) = P (

Difference between CI and SI for 3 years (D) = P (

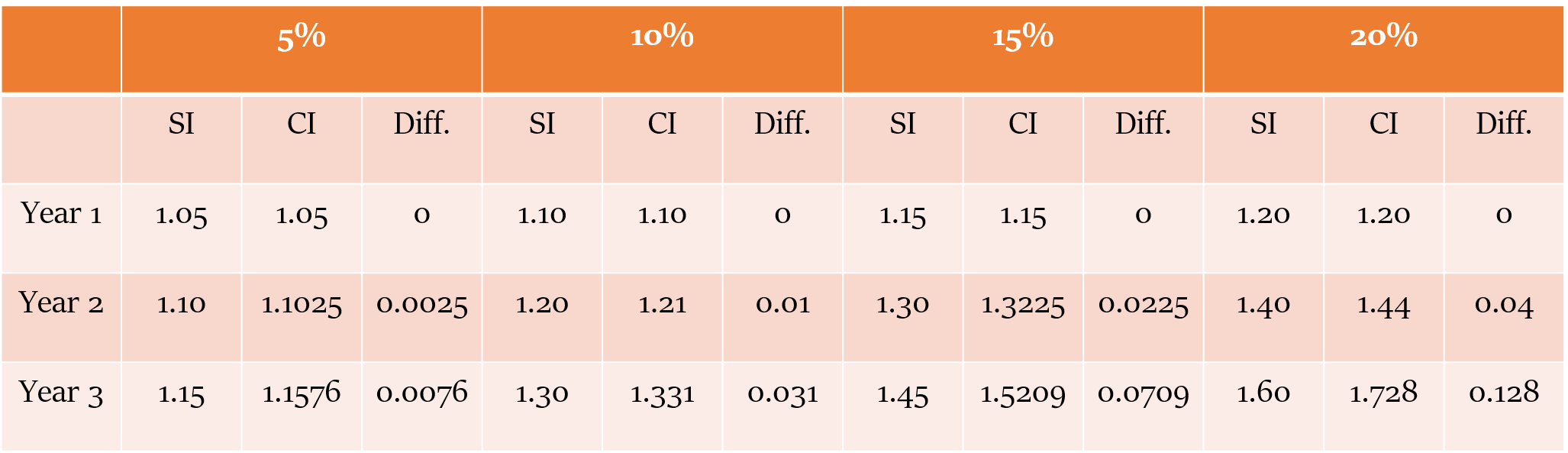

For those who are more into mugging things up, here’s a table that may fasten up the calculation process manifold.

If the initial principal is Rs. 1, then the SI, CI and there difference will be:

Concept 2

If simple interest for a certain sum for 2 years at the annual rate of interest r% is SI, then

Compound Interest (CI) = SI ( 1 +

Note : This formula is applicable only for 2 years.

=

Q. If the difference between simple and compound interest on a certain sum of money lent for 2 years at 6% per annuum is Rs. 90, then find out the original sum lent out.

Explanations :

Difference between CI and SI for 2 years (D) = P (

Or 90 = P (

Or P =