Simple Interest

Simple Interest (S.I.) Formula

Simple Interest (SI) = $\frac{Principal × Rate × Time}{100}$ = $\frac{Prn}{100}$

(we use T or N for number of time periods)

Note: This formula of Simple Interest (SI) is nothing but:

SI = r% of P + r% of P + r% of P …….n times

So, Simple interest (SI) is calculated only on the principal regardless of the interest earned so far.

Insights from Simple Interest (S.I.) Formula

Let us draw some insights from this formula:

Insight 1: SI ∝ P, r and n

SI is directly proportional to P, r and n.

So, if principal triples, rate halves and number of years become double, then:

New SI = 3 x (1/2) x 2 x Old SI = 3 x Old SI

Insight 2: Yearly Interest is constant

We can also write the simple interest formula as:

SI = Pr/100 + Pr/100 + Pr/100 + ……n times (n is the number of years)

So, Total S.I. in n years = Interest in 1 year × n

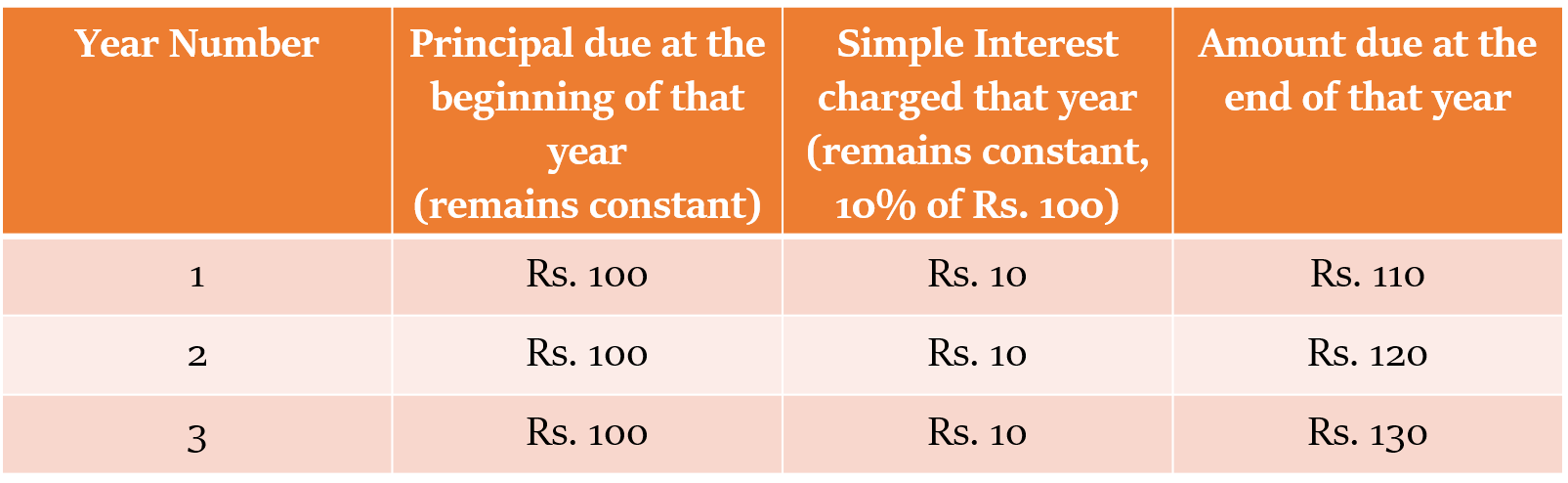

Insight 3: Principal remains constant

In case of Simple Interest:

- The principal remains the same every year

- The interest for any year is the same as that for any other year.

For example, consider the scenario wherein Rs. 100 is borrowed at 10%.

Insight 4

If rate of interest is r = x + y + z, then

SI = P (x + y + z) n /100 = Pxn/100 + Pyn/100 + Pzn /100

So, SI @ r% = SI @ x% + SI @ y% + SI @ z%

For example, SI at a rate of 17.5% can also be considered as collective effect of SI at the rates of 10% and 5% and 2.5% (the sum should come out to be 17.5).

Insight 5

S.I. = P x (rn/100) = rn% of P

So, if r = 4% and n = 5 years, then total S.I. will be 20% of the principal invested.

If principal borrowed is same, then SI in all these scenarios will remain the same:

r = 10% & n = 4 years

r = 8% & n = 5 years

r = 5% & n = 8 years

r = 1% & n = 40 years

(the product of r and n should come out to be the same)

Q. What will be the simple interest charged on a sum of money of Rs. 3000, borrowed for 3 years at an interest rate of 8%

Explanations :

Simple Interest (SI) = $\frac{Prn}{100}$ = $\frac{(3000 × 8 × 3)}{100}$ = 30 × 8 × 3 = Rs. 720

Simple interest rate of 8% for 3 years is equivalent to 8 × 3 = 24% of interest rate for one year

So, Simple Interest (SI) = 24% of 3000 = Rs. 720

Q. Mr. Mathur earns Rs. 120 as simple interest in 6 years, at a rate of 5%. What must be the principal amount that he invested?

Explanations :

Simple Interest (SI) = $\frac{Prn}{100}$

Or 120 = $\frac{(P × 5 × 6)}{100}$

Or P = 1200/3 = Rs. 400

Simple interest rate of 5% for 6 years is equivalent to 5 × 6 = 30% of interest rate for one year

So, Simple Interest (SI) = 30% of principal

Or 120 = 30% of P = (30/100) × P

Or P = (120 × 100) / 30 = Rs. 400

Interest of Rs. 120 was earned in 6 years.

So, interest earned in one year = 120/6 = Rs. 20

Now, interest earned per year = r% of P

5% of P is equivalent to Rs. 20

So, 100% of P must be equal to 20 × (100/5) = Rs. 400

Q. If a sum of money becomes Rs. 1500 in 2 years and Rs. 2200 in 7 years, then what must have been the initial sum of money borrowed?

Explanation: Short Trick Method

Number of years = 7 – 2 = 5 years

If it has not been mentioned whether it is a SI or CI, we will assume it to be SI in such cases.

We know that the difference in amounts is due to the interest earned. We also know that we earn the same simple interest every year.

So, simple interest earned per year = Difference in amount / Number of years = 700/5 = Rs. 140

So, initial principal amount = Amount after 2 years – interest earned in two years = 1500 – (2 × 140) = 1500 – 280 = Rs. 1220

Amount (in case of SI)

Amount, A = P + $\frac{Prn}{100}$ = P (1 + $\frac{rn}{100}$)

(Where, SI = Simple Interest, P = Principal, r = Rate of Interest, n = Time, A = Amount)

If P = Rs. 100, then SI = r n

And so, A = 100 + r n

We can also rearrange the formula and get the following versions of the same formula:

P = $\frac{100 × A}{100 + rn}$

SI = $\frac{Arn}{100+rn}$

Q. Amount received by a lender after 4 years is Rs. 360. What must have been the money lent by him at a rate of 5%?

Explanations :

P = $\frac{100 × A}{100 + rn}$ = $\frac{100 × 360}{100 +(5)(4)}$ = $\frac{100 × 360}{120}$ = Rs. 300

Simple interest rate of 5% for 4 years is equivalent to 5 × 4 = 20% of interest rate for one year

So, Simple Interest (SI) = 20% of principal

Or Amount = 120% of principal (as amount = principal + SI = 100% of principal + 20% of principal)

Or 360 = 120% of P = (120/100) × P

Or P = (360 × 100) / 120 = Rs. 300

If P = 100, then:

A = 100 + r n = 100 + (5 × 4) = 120

But we know that A = Rs. 360

So, P = 100 × (360/120) = Rs. 300

Non-annual SI rates

Not all simple interests are calculated on annual basis. The rates may be calculated on a quaterly, monthly, weekly or even daily basis.

If interest is calculated k times a year, then rate = (r/k)% and time = kn

For example:

If rate of interest is half-yearly, then rate = (r/2)% and time = 2T

If rate of interest is quarterly, then rate = (r/4)% and time = 4T

If rate of interest is monthly, then rate = (r/12)% and time = 12T

Money becomes n times (in case of SI)

Formula 1

If a sum of money becomes k times in n years at simple interest, then formula for calculating rate of interest is given as :

R = $\frac{100(k−1)}{n}$%

Q. If a sum of money four times itself in 30 years, then what is the rate of interest?

Explanations :

A = P + $\frac{Prn}{100}$ = P(1 + $\frac{rn}{100}$)

Or 4P = P(1 + $\frac{30r}{100}$)

Or 400 = 100 + 30r

Or 30r = 300

Or r = 10%

Sum of money becomes 4 times, that is an increase of 300%.

So, simple interest = 300% of P = (rn/100) P

Or rn = 300

Or r = 300/n = 300/30 = 10%

If a sum of money becomes n times in T years at simple interest, then rate of interest= $\frac{100(k−1)}{n}$% = $\frac{100(4−1)}{30}$% = 300/30% = 10%

Formula 2

If a sum of money at a certain rate of interest becomes $k_1$ times in $n_1$ years and $k_2$ times in $n_2$ years, then

$𝑛_2 = \frac{k_2 − 1}{k_1 − 1} × 𝑛_1$

Q. If a sum of money, lent at simple interest, doubles itself in 4 years, then in how many years will it become 8 times?

Explanations :

A = P + $\frac{Prn}{100}$ = P(1 + $\frac{rn}{100}$)

Or 2P = P(1 + $\frac{4r}{100}$)

Or P = 4Pr/100

Or r = 25%

Hence, 8P = P(1 + $\frac{25n}{100}$)

Or 800 = 100 + 25n

Or n = 700/25 = 28 years

If a sum of money at a certain rate of interest becomes $k_1$ times in $n_1$ years and $k_2$ times in $n_2$ years, then:

$𝑛_2 = \frac{k_2 − 1}{k_1 − 1} × 𝑛_1$ = $\frac{8 − 1}{2 − 1} × 4$ = 7 × 4 = 28 years

Sum of money becomes 2 times, that is an increase of 100% of P.

So, simple interest in 4 years = P

To become 8 times, simple interest earned should be 7P.

We know that simple interest earned every year remains the same.

So, if P interest is earned in 4 years

Then, 7P interest will be earned in 4 × (7P/P) = 28 years

Q. If a sum of money, lent at simple interest, triples in 8 years, then in how many years will it become four times?

(a) 10 (b) 12 (c) 15 (d) 9

Explanations :

Let the principal be P and the rate of interest be R. As the amount triples in 8 years, it means that interest earned is 2P.

Simple Interest = (P × R × n)/100

or 2P = (P × R × 8)/100

or R = 25%

Let the number of years in which the amount become four times be N.

Hence, 3P = (P × R × N)/100

or 3 = (25 × N)/100

or N = 12 years

Answer: (b)

Let the principal be P. As the amount triples in 8 years, it means that S.I. earned is 2P.

It means that P interest is earned every 4 years.

Now, to become 4 times the original amount, the interest earned must be 3P. It will take 12 years (3 × 4) to earn it.

Answer: (b)

Formula 3

If a sum of money at a certain time becomes $k_1$ times at $r_1$ rate of interest and $k_2$ times at $r_2$ rate of interest, then

$r_2 = \frac{k_2 − 1}{k_1 − 1} × r_1$

Q. A sum of money becomes 4 times of itself at 6% rate of interest. At what rate will it become 6 times in the same time?

Explanations :

A = P + $\frac{Prn}{100}$ = P(1 + $\frac{rn}{100}$)

Or 4P = P(1 + $\frac{6n}{100}$)

Or 3P = 6Pn/100

Or n = 50 years

Hence, 6P = P(1 + $\frac{50r}{100}$)

Or 600 = 100 + 50r

Or r = 500/50 = 10%

If a sum of money at a certain time becomes $k_1$ times at $r_1$ rate of interest and $k_2$ times at $r_2$ rate of interest, then

$r_2 = \frac{k_2 − 1}{k_1 − 1} × r_1$ = $\frac{6 − 1}{4 − 1}$ × 6 = 10%

Sum of money becomes 4 times, that is an increase of 300% of P.

So, simple interest at 6% rate = 3P

To become 6 times, simple interest earned should be 5P.

We know that simple interest earned every year remains the same.

So, if 3P interest is earned at 6% rate of interest

Then, 5P interest will be earned in 6 × (5P/3P) = 10%